Sole's Tax Estimator is a powerful tool that will allow you to track and forecast your tax liability throughout the year.

The tax estimator has been configured to mirror the sole trader tax structure outlined by the Australian Taxation Office (ATO), and therefore, should provide an accurate estimation of your tax liability for the year.

How do I find the Tax Estimator in Sole?

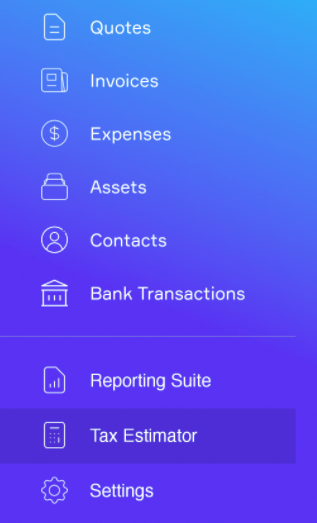

There are two ways to open the Tax Estimator:

1. From the Dashboard: scroll down to the bottom of the page until you find the Tax Estimator tile. When you have completed your tax calculation, this tile will display your most recent forecast tax liability.

2. From Sole's sidebar: select the 'Tax Estimator'

How do I use the Tax Estimator?

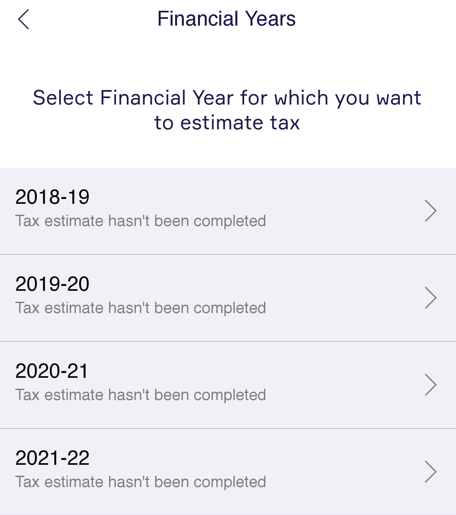

Select your financial year

You will first have to select the financial year for which you would like to calculate your tax liability. Sole allows you to enter your business data for prior financial years in order to accurately capture balances that may be brought forward into the current year, such as prior year capital gains and losses.

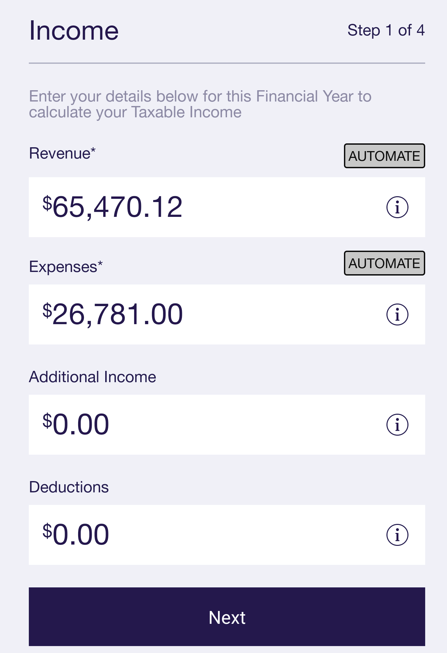

Step 1 - Income

Starting from the most fundamental items in your tax calculation, enter your business' revenue, expenses, additional income and deductions.

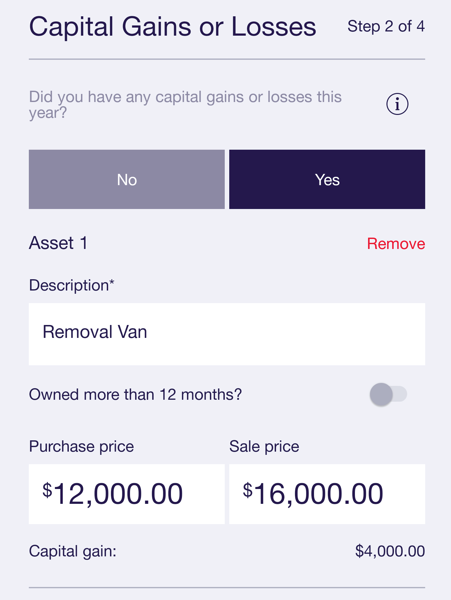

Step 2 - Capital Gains or Losses

Complete this section if a capital gains tax (CGT) event has occurred within the year. You may have made a capital gain or capital loss. For most CGT events, you make a:

- capital gain if the amount of money and property you received, or were entitled to receive, from the CGT event was more than the cost base of your asset; you may then have to pay tax on your capital gain

- capital loss if the amount of money and property you received, or were entitled to receive, from the CGT event was less than the reduced cost base of your asset.

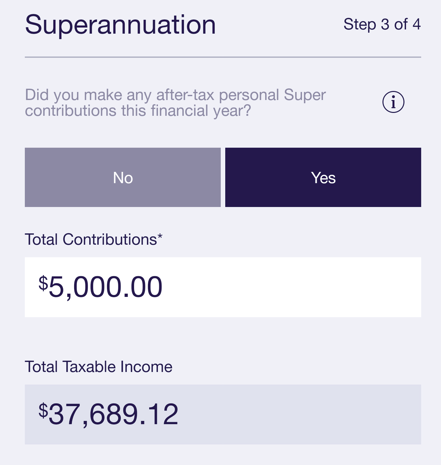

Step 3 - Superannuation

In this step, you should enter any after-tax personal Super contributions you have made. These are contributions that are in addition to any compulsory super contributions made, and should not include super contributions made through a salary-sacrifice arrangement.

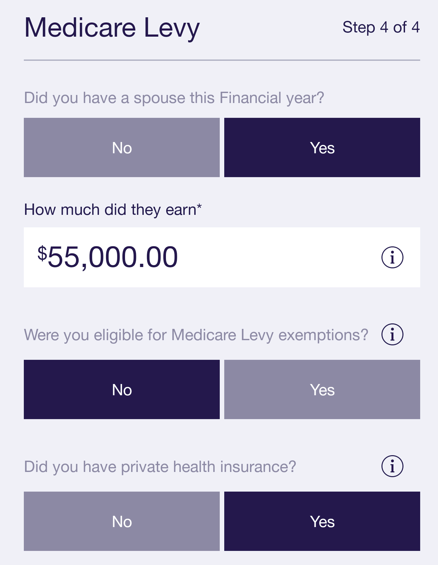

Step 4 - Medicare Levy

You may get a reduction or exemption from paying the Medicare levy, depending on your and your spouse's circumstances. You need to consider your eligibility for a reduction or an exemption separately.

- Enter your spouse' taxable income in order to determine your family's income

- Confirm if you are are eligible for Medicare Levy exemptions for individuals with specific medical requirements, foreign residents or if you are not entitled to Medicare benefits.

- Indicate whether you have private health insurance.

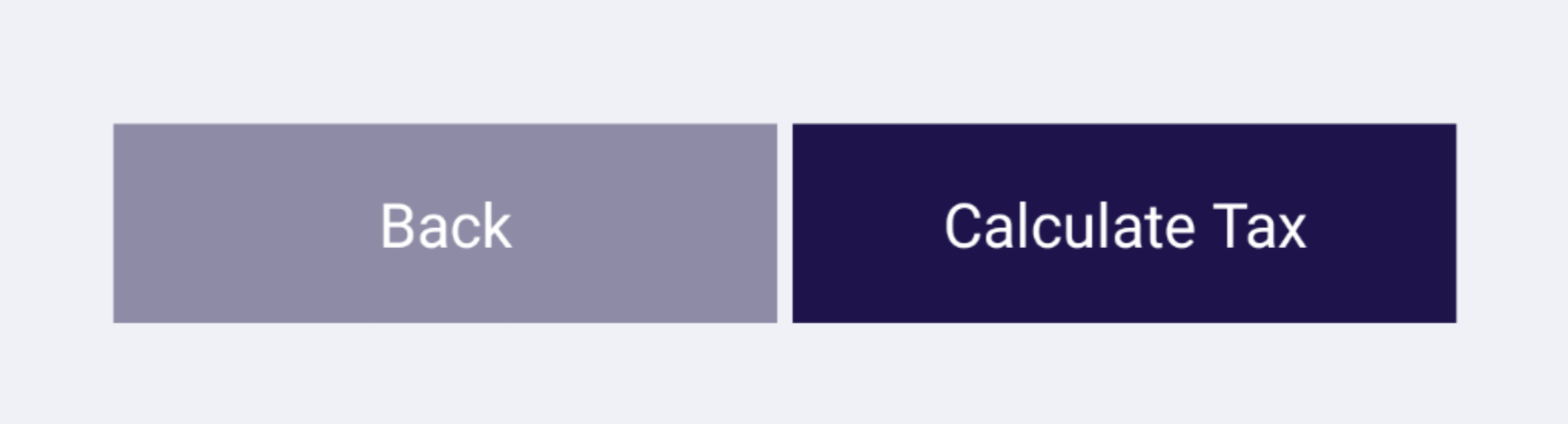

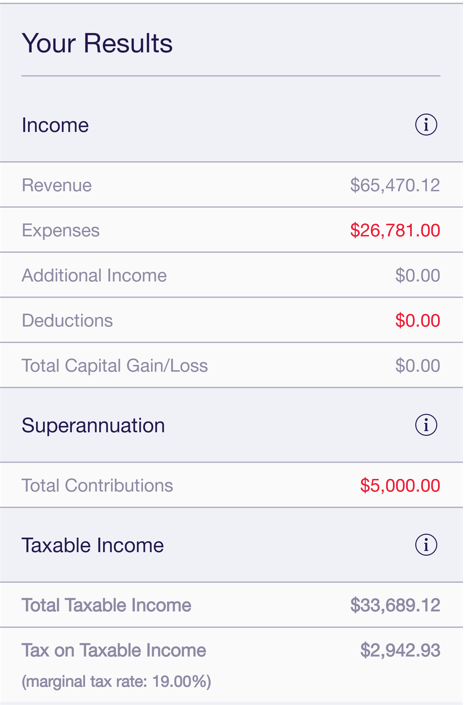

Calculate your tax

When all of your inputs are ready, hit 'calculate tax' and you will be presented with your Tax Results for the period

Want To Read More?

Check out our tax time blog at: https://soleapp.com.au/lets-talk-about-tax/